does idaho tax pensions and social security

How Much Does Idahos Teacher Pension Plan Cost. Most pension benefits are currently taxable on your Idaho state income tax return.

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

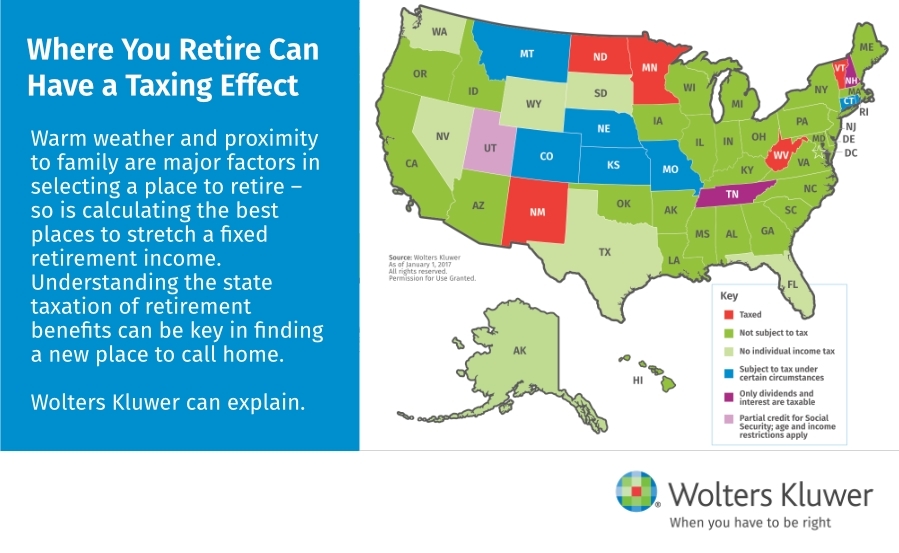

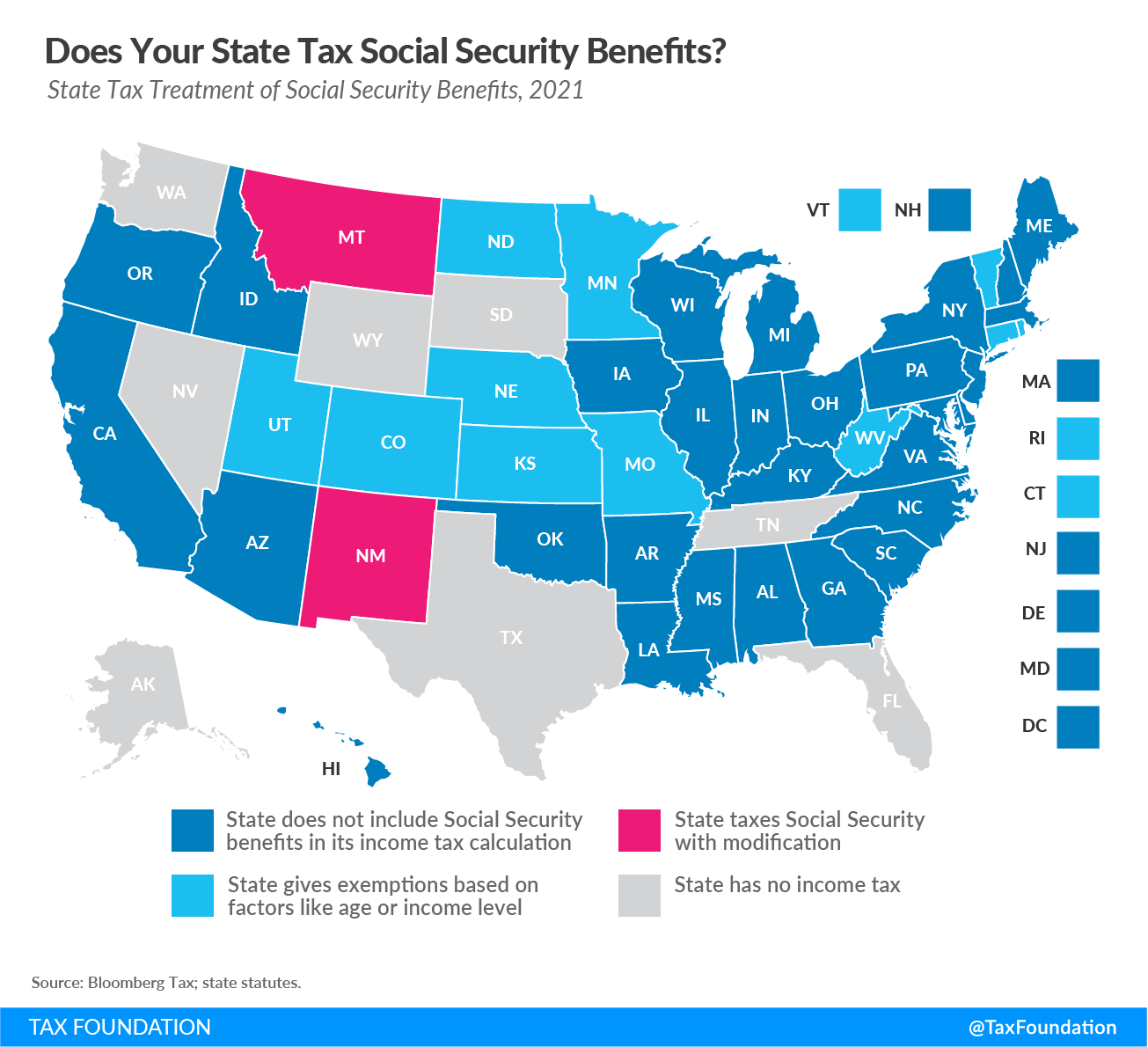

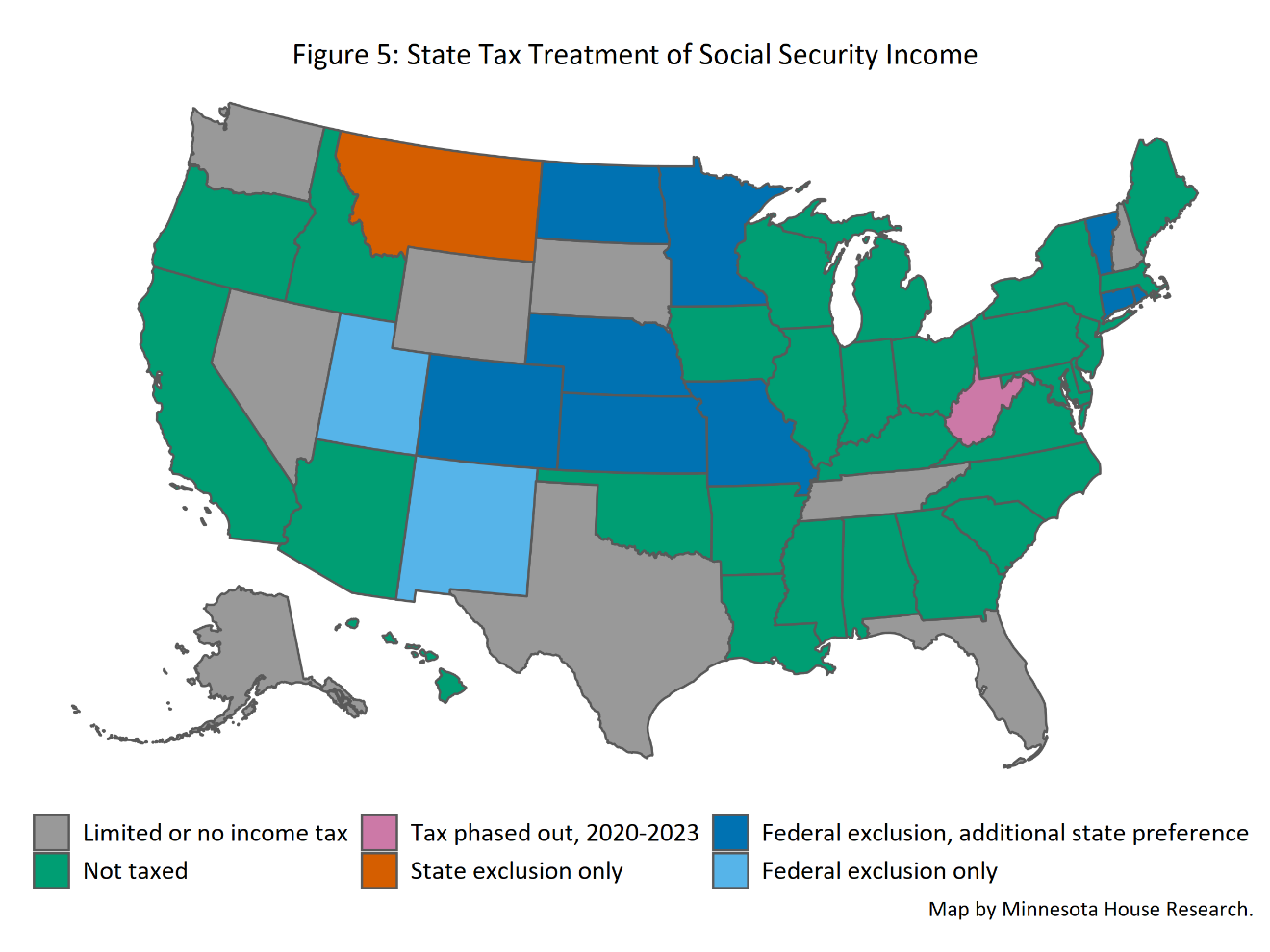

The states that tax Social Security are Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico.

. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590. Which states do not tax pensions and Social Security. Social Security income is not taxedWages are taxed at normal rates and your marginal state.

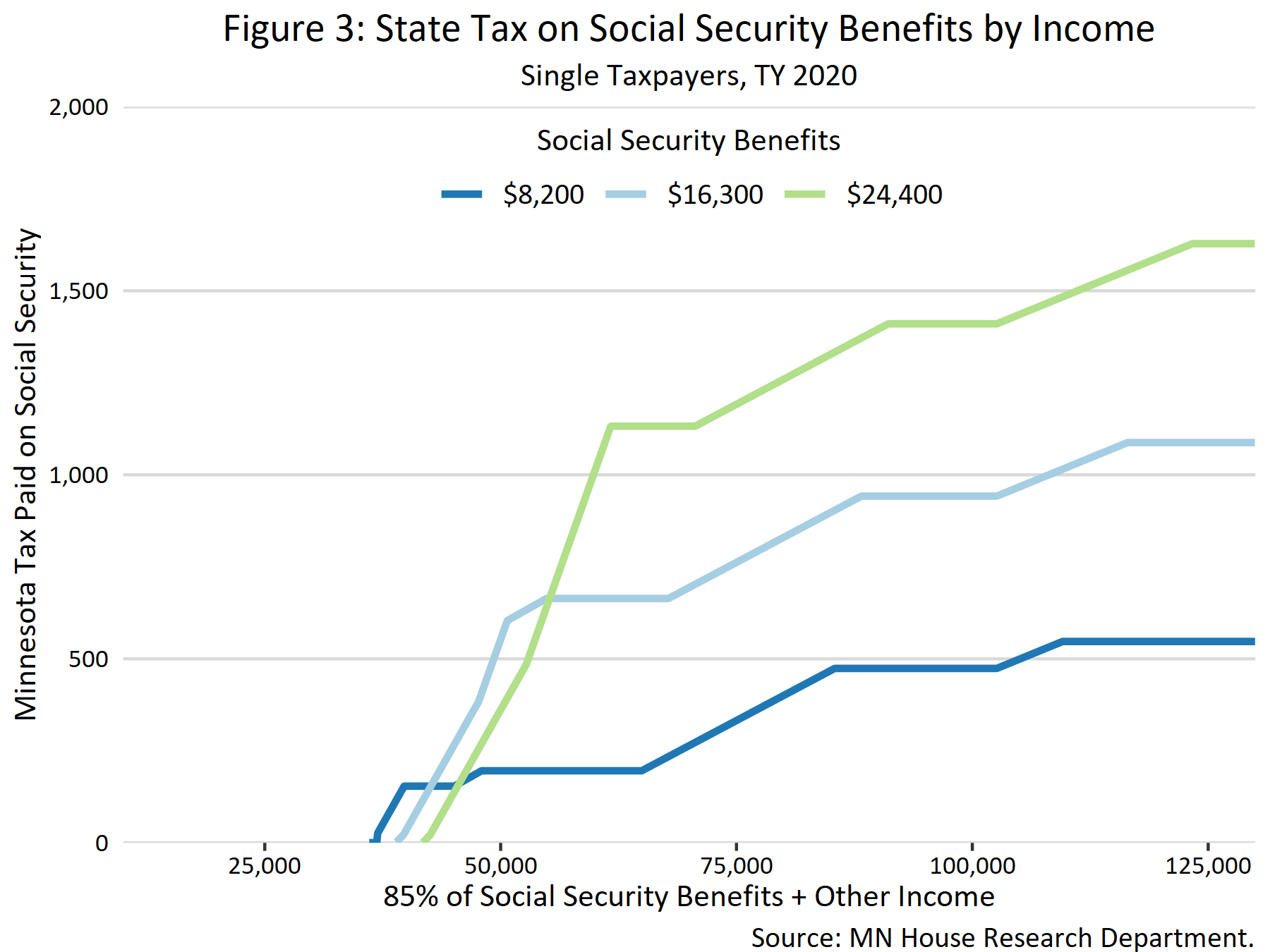

Are retirement pensions taxed in Idaho. As is mentioned in the prior. Using an online Social Security taxation calculator we estimate that 29393 of their Social.

As is mentioned in the prior section it does not tax Social Security income. Additionally the states property and sales taxes are relatively low. What states tax Social Security and pensions.

As of 2022 there are 14 states that dont tax pensions and 38 states that dont tax Social Security benefits. Wages are taxed at normal rates and your marginal state tax rate is 590. Other forms of retirement income such as from a.

Social Security retirement benefits are not taxed at the state level in Idaho. Alaska Nevada Washington and Wyoming dont have state income taxes at all and Arizona California Hawaii. Idaho does not currently tax Social Security benefits as of 2021.

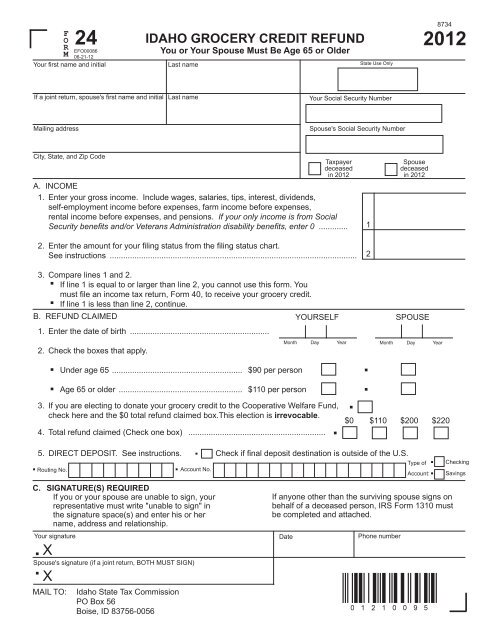

Idaho is tax-friendly toward retirees. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. The state taxes all income except Social Security and Railroad Retirement benefits and its current top tax rate of 6 65 before 2022.

Nonresidents pay tax only on income from idaho sources. What states tax Social Security and pensions. Social Security retirement benefits are not taxed at the state level in Idaho.

Does Idaho tax my pension. Yes Deduct public pension up to 37720 or. Social Security income is partially taxed.

Other forms of retirement. There is a formula that determines how much of your Social Security is taxable. 800-732-8866 or Illinois Tax Department.

The exemption is available to single taxpayers with less than. Social Security retirement benefits are not taxed at the state level in Idaho. You also dont have to pay taxes on your social security benefits.

52 rows Retirement income and Social Security not taxable. Idaho taxes are no small potatoes. New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income.

Additionally the states property and sales taxes are relatively low. So we first have to look how the. Idaho is tax-friendly toward retirees.

Retirement income and social security not taxable. Other forms of retirement. Part 1 Age Disability and Filing.

Does Idaho tax pension benefits. Paying less in taxes can reduce strain on a retirees budget and help. Additionally the states property and sales taxes are relatively low.

The states that tax Social Security are Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico. Withdrawals from retirement accounts are fully taxed.

States Where Retirees Will Get The Best Social Security Check Boost In 2022

Why Wyoming May Be The Ideal Place For Retirement

Prepare And E File 2021 Idaho State Individual Income Tax Return

13 States That Tax Social Security Income The Motley Fool

Idaho Retirement Tax Friendliness Smartasset

Idaho Estate Tax Everything You Need To Know Smartasset

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Bryan Zollinger On Social Security Marco For Idaho Representative

10 Best Places To Retire In Idaho Smartasset

Maximize Social Security Benefits In New York

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

13 States That Tax Social Security Benefits Tax Foundation

States That Won T Tax Your Federal Retirement Income Government Executive

Quot 6 A Idaho State Tax Commission Idaho Gov

Taxation Of Social Security Benefits Mn House Research

Taxation Of Social Security Benefits Mn House Research

:max_bytes(150000):strip_icc()/5ToolsforRetirementPlanning-3954dc7e62a04daea0c47422dd74d33d.jpg)